ENERGY:

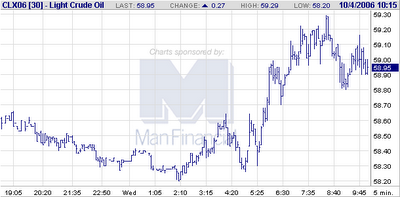

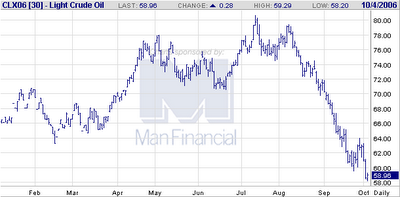

In response to many emails regarding the actual trading on the floor of the NYMEX crude oil contract. The "locals" (Floor traders) probably don't even know what the long term trend may be. They trade huge volume to scalp tenths and most use a five minute chart (if they use charts at all). A mini-mini-micro trend is what they trade. Most trade for themselves AND big commercial customers (they are no longer allowed to trade both at the same time). They may trade as many contracts as they have margin money in their accounts, which is one hell of a lot of oil. 10,000 crude contracts; 10,000 barrels which is 10,000 times 42,000 gallons. Holy shit, you might say. And you'd be right: 420,000,000 gallons of crude can be traded per person or firm, in some cases even more. But this gets very complicated and the limits in the cash month are much lower. But from this you can see that the large commercials can and do move the markets. Every penny move in the price of crude equals $10 per contract so you can see what the small player is up against. A 1,000 lot trade scalped at tenths equals ten K, a lot of money to be made in seconds. Most of the action is by the large corporate "hedgers;" the oil companies that own the oil and are "hedging their risk." Crude is traded all the way out to December 2012, and the total volume is in the millions of barrels. Having said all this, Directly below is a November Crude five minute chart. At bottom is the latest daily chart. You can see the difference.

When you check out the huge volume you can easily see how it is virtually impossible to "rig" the market. Nobody has enough money to do it. And oh, crude is traded on every exchange in the world which means.......

When you check out the huge volume you can easily see how it is virtually impossible to "rig" the market. Nobody has enough money to do it. And oh, crude is traded on every exchange in the world which means.......

10/04/2006

Subscribe to:

Post Comments (Atom)

3 comments:

Howard, a barrel of oil is 42 gallons, not 4.2 as per your math. So your 10,000 barrels is 420,000 gallons. Good point though.

Sorry, but my math is correct.42,000 times 10,000 is 420 million. I calculate large numbers on line.

Sorry but go HERE for the contract specs. 42,000 gasllons per contract. BUT I don't know the specs for overseas markets, many of which are different.

Also a huge quantity is traded off market. And I did not include spreads. And so on.

Post a Comment