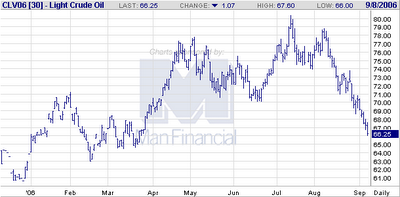

A TEMPORARY HALT TO CRUDE OIL COLLAPSE

The shorts in crude have made a quick killing. Markets almost always collapse faster than they explode to the upside and I am assuming that all the guys on the rigs called their wives, told them to take $20K over to their friend Bernie and tell him to short. Margin (money you have to put up to trade) is $4,000 per contract. The market came down a nickel (+5K per contract) they bailed when it formed a channel, and when the market rose they put in sell stops just below the low of the first move. Five contracts would have netted them---netted---60K per five contract lot and they are still short. I'm always glad when the grunts make a score. Will the specs come back in and drive prices back up? I don't think they can pull it off this time because the oil producers who hedge these things will bury them. What about the execs? They wouldn't dare. The price of being caught is jail. I look for a "short covering" rally late today

The shorts in crude have made a quick killing. Markets almost always collapse faster than they explode to the upside and I am assuming that all the guys on the rigs called their wives, told them to take $20K over to their friend Bernie and tell him to short. Margin (money you have to put up to trade) is $4,000 per contract. The market came down a nickel (+5K per contract) they bailed when it formed a channel, and when the market rose they put in sell stops just below the low of the first move. Five contracts would have netted them---netted---60K per five contract lot and they are still short. I'm always glad when the grunts make a score. Will the specs come back in and drive prices back up? I don't think they can pull it off this time because the oil producers who hedge these things will bury them. What about the execs? They wouldn't dare. The price of being caught is jail. I look for a "short covering" rally late today with prices closing higher (I was completely wrong, closed down $1.05 at $66.25).. As this is written, prices have dropped below $67 ($66.25) basis October BUT remember, OPEC meets next week so look for this supply glut driven decline to end. How about heating oil? Well those of you users in the east are fucked, because all supply on hand is a result of $73 plus crude prices (However, all dealers and suppliers hedge and if they shorted, the home heating oil prices for consumers could plunge). The big surprise is natural gas as prices decline because of supplies. All U.S. crude production will be on line very soon and some production will exceed prior figures. Gasoline prices in LA have suddenly come down seven to nine cents per gallon, but only in some places. They all get their gasoline from the same places, so ?????.

No comments:

Post a Comment